MARKET OVERVIEW

The Retail sector was a pleasant surprise as 2022 ended. While the broader commercial real estate market was posting transaction declines, retail deal volume grew 4 percent year-over-year and net absorption hit its highest level in five years. Rental rates rose 4 percent from the last quarter. The resurgence of local consumer spending and the quickened pace of store adaptation to e-commerce fed confidence in the asset class. Retailers rightsized their space and landlords remixed their offerings. January’s retail spending figures and recent expansion plans by major discount stores are bolstering the sector’s fundamentals coming into 2023.

There are significant forces hampering the CRE market. The highest commercial and multi-unit residential interest rates in over a decade have poured cold water on borrowing. The uncertainty around inflation and the Federal Reserve’s plans, as well as a potential recession, make it difficult for industry players to price assets. Deal activity has been further discouraged by “sticky” cap rates and prices, despite jumps in the loan and 10-year Treasury rates. But market forces may be starting to work. The RCA CPPI National All-Property Index plunged 4.8 percent in January from a year ago. Cap rates are also inching up, although the Mortgage Banker Association’s CREF Forecast still showed a wide gap in price expectation in January.

Reflecting these conditions, the market retrench extended into early 2023. Even Industrial and Apartment activity is contracting, albeit from record-setting levels a year earlier. As expected, the Office sector is showing some strain. Office properties transaction volume was below the pre-pandemic 5-year average and vacancy rates were at almost 20 percent. A readjustment in office space usage is expected as the full impact of the new hybrid work model evolves.

However, as the Mortgage Bankers Association recently noted, the fundamentals of the main asset classes (outside of Office) remain strong. According to National Association of REALTORS® commercial data*, Multifamily rental rate growth was 3.7 percent in 2022. Industrial vacancy rates were pushed down to a record 3.4 percent, driving up rents further. The revival of the family vacation and business travel was evident in the full recovery of hotel revenue in 2022. Delinquencies are not yet a reason for concern. Combine this with almost record levels of investment dollars sitting on the sidelines, and some forecasters believe that the current situation could be a “painful pause” rather than the beginning of a protracted downcycle.

A DEEPER LOOK – REGIONAL RETAIL MARKETS

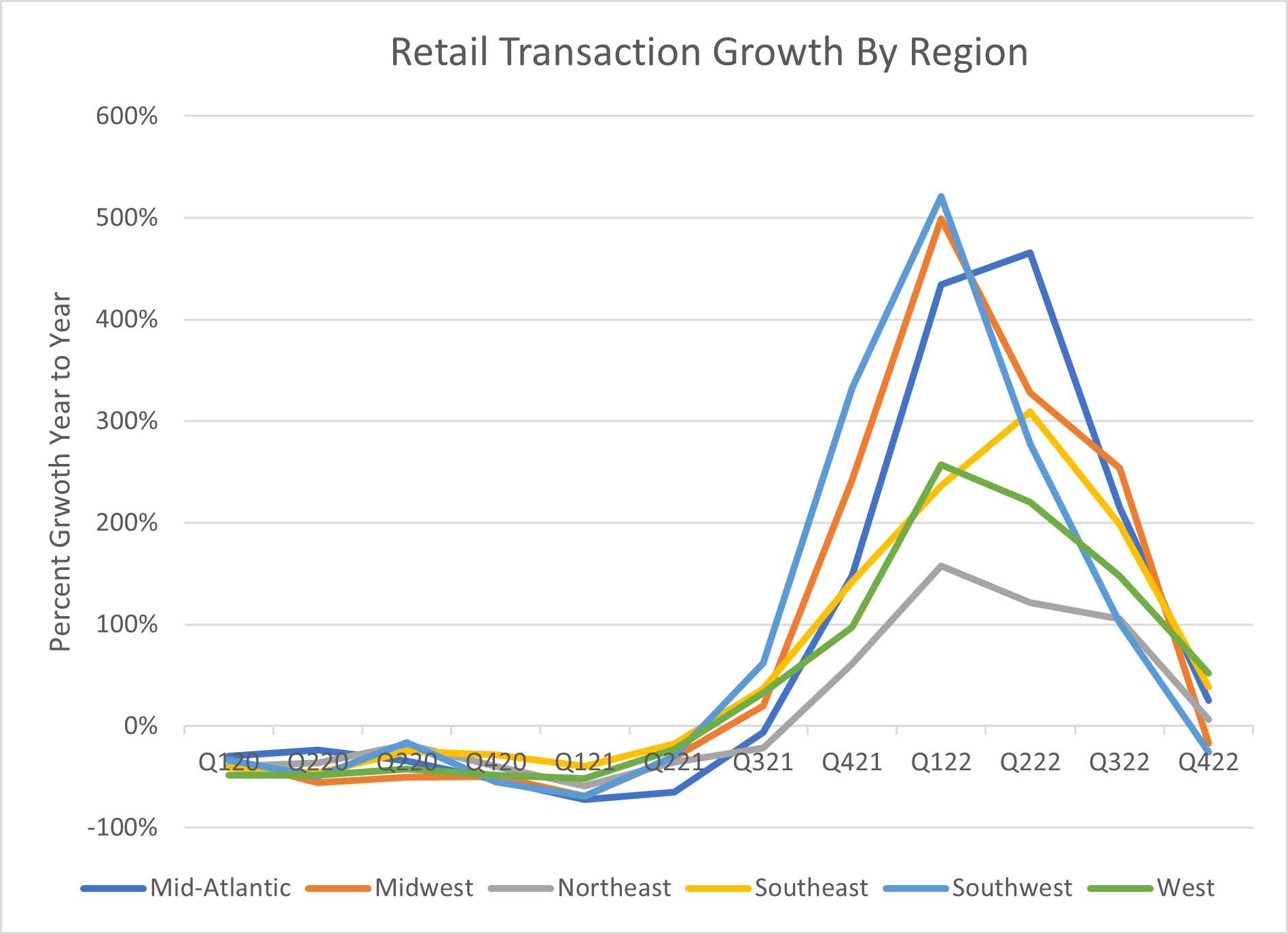

Looking at retail transactions from a regional perspective over the last few quarters, there has been a shift in the best performing markets. For the first year and a half of the pandemic, when high uncertainty and COVID-19 concerns were widespread, the regions moved relatively as one. But beginning late in 2021, as consumers ventured out again, the markets separated into two tiers, with the Southwest, Midwest and Mid-Atlantic states rebounding quickly.

Recently, some regions were driven back together by rising interest rates and broad economic concerns. The Southeast and West have now joined the Mid-Atlantic region to post respectable advancement. As JLL recently noted, the Prime Urban Corridors (which are mostly U.S. coastal cities) are having a bit of a renaissance. While it is too early in the year to see if these trends persist, markets such as Philadelphia, San Jose and New Orleans are already showing transactions at least on par with last quarter.

Source: RCA and Property Data, Ltd.

To see how the quarter ends, stay tuned for next month’s Economic Update 1Q 2023.

* Copyright ©2023 “Commercial Market Insights Report – January 2023.” NATIONAL ASSOCIATION OF REALTORS®. All rights reserved. Reprinted with permission. March 2023, https://www.nar.realtor/sites/default/files/documents/cmr_jan_2023.pdf